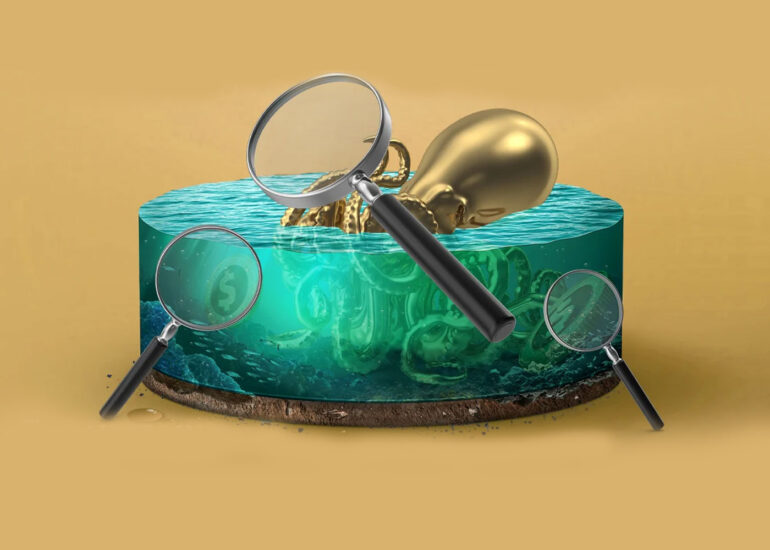

Some offers that Kraken made to its US clients may have violated securities laws and now are the subject of inquiry in court. The US Securities and Exchange Commission is looking into whether cryptocurrency exchange Kraken broke the laws for providing securities.

The inquiry relates to specific offers Kraken made to US clients, according to a February 8th Bloomberg article. Based on a source with knowledge of the situation, the inquiry is advancing and a resolution may be reached soon. Which offers, though, are being examined by the securities regulator at this time is unknown.

What Does the Inspection of Kraken’s Signify?

The SEC does not comment on the presence or non-existence of a potential inquiry, an SEC representative said in response to a question regarding the supposed investigation in a report they made to Cointelegraph. Requests for comment from Kraken were not immediately answered.

In December, Gensler stated that his major objective for regulating cryptocurrencies throughout 2023 was to bring cryptocurrency exchanges and lending platforms into compliance. According to Gensler, this may be accomplished by having businesses register with the SEC or by conducting inspections.

How will the Situation Unroll for Kraken?

“There are no tokens out there that are securities that we are interested in listing”, said Kraken CEO Dave Ripley in September, adding that he did not see a need to register Kraken as an exchange with the SEC because it does not provide securities.

In the meantime, “The sale of LBRY Credits (LBC) in the secondary market does not, however, constitute a security”, the SEC recently conceded during a January 30 appeal hearing in LBRY v. SEC, after the court was convinced by an attorney’s argument. John Deaton emphasizes that in comparable circumstances, courts have never noted the underlying asset as collateral.

The “Howey test” is often used by the regulator to assess what qualifies as a bond. The 1946 SEC v. Howey decision, which established a precedent about whether transactions should be regarded as securities in the US, gave rise to the term. It is argued that when money is invested in a joint venture with profits made only via the labor of a third party, the transaction qualifies as an investment contract and is thus regarded as a security.

Would you like to check: Saudi Arabia To Partner With The Sandbox For Future Metaverse Plans