This article centers around a thorough assessment of OM coin’s technical and fundamental attributes using data obtained from www.coinmarketcap.com . Our report aims to address vital inquiries regarding the projects associated with the cryptocurrency ; determining significant factors affecting its market value ; reviewing which are reliable exchanges for trading it ; identifying traded currency pairs ; exploring assorted key metrics that demonstrate critical aspects of performance such as highest low price values attained among other essential economic indicators. We will also provide regular weekly graphical or technical analyses aimed at assisting potential investors evaluate feasible investment risks areas while identifying prospective profits.

What is MANTRA (OM) Coin?

MANTRA (OM) coin is a cryptocurrency that serves as the native token of the MANTRA DAO platform . MANTRA DAO is a decentralized finance (DeFi) ecosystem built on top of the Polkadot blockchain . The platform aims to provide users with various DeFi services , including staking , lending , and governance . The OM coin plays a vital role in governing and participating in the MANTRA DAO ecosystem by allowing holders to vote on proposals and earn rewards for their participation . It also acts as a medium of exchange within the platform for accessing different services and earning incentives.

If you want to know more about the MANTRA (OM) coin , you can visit its website.

https://www.mantraomniverse.com/

Projects:

MANTRA (OM) coin has several projects and initiatives associated with it. Here are some notable ones :

- Staking : The MANTRA DAO platform allows users to stake their OM tokens and earn rewards in the form of additional OM tokens .

- Lending/Borrowing : Users can utilize the lending and borrowing features on the MANTRA DAO platform , where they can provide liquidity or borrow assets by using their OM tokens as collateral .

- Governance : Holders of OM tokens have governance rights within the MANTRA DAO ecosystem , allowing them to vote on proposals that shape the future development and direction of the platform .

4Community Development : MANTRA DAO actively engages its community through various initiatives like hackathons , grants programs, and partnerships to foster innovation and growth within the ecosystem .

- Cross-Chain Integration : With its foundation on Polkadot’s interoperable blockchain infrastructure, MANTRA DAO aims to explore cross-chain integration possibilities for seamless asset transfers across different blockchains .

These are just a few examples of projects associated with MANTRA (OM) coin; however , keep in mind that new projects may emerge as the ecosystem evolves over time .

Factors affecting price:

The price of MANTRA (OM) coin can be influenced by various factors , including:

- Market Sentiment : Like any cryptocurrency, the price of OM coin can be affected by general market sentiment and investor perception . Positive news , adoption , and overall market conditions can drive up the price , while negative events or sentiments may lead to a decrease .

- Adoption and Utility : The level of adoption and utility within the MANTRA DAO ecosystem plays a significant role in determining the value of OM tokens. Increased usage of the platform’s services , such as staking and lending/borrowing , can create demand for OM tokens and potentially drive up their price .

- Token Supply : The supply dynamics of OM tokens also impact their price. Factors like token distribution mechanisms, token burns or buybacks carried out by the project team, inflation rate if applicable, and circulating supply all influence supply-demand dynamics that affect prices .

- DeFi Trends : As a decentralized finance (DeFi) project built on Polkadot blockchain infrastructure, trends in the broader DeFi space can also have an impact on MANTRA (OM) coin’s price . Developments in other popular DeFi projects or changes in regulatory environments may indirectly influence investor sentiment towards OM tokens .

- Platform Development Milestones : Progress made in achieving development milestones outlined by MANTRA DAO could positively affect its token ‘s value as it demonstrates growth potential for the ecosystem .

It is important to note that cryptocurrency markets are highly volatile and subject to numerous external factors beyond these examples alone ; hence caution should always be exercised when evaluating investment decisions .

Where can I buy MANTRA Coin (OM)?

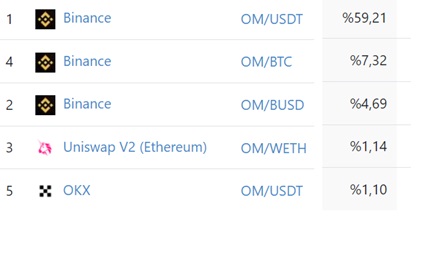

Exchange Pair Volume

MANTRA Coin (OM) Baseline Assessment :

The market cap of the MANTRA (OM) coin is $ 17.160.897 and its circulating supply is 691.557.404 units. Its total supply is 888.888.888 units, with a fully diluted valuation of $ 22.057.649 .

What is the high price point for MANTRACoin (OM)?

MANTRA Coin (OM) highest price is $0.8716 recorded on Mar 16, 2021. The current price is -97.17% lower than the all-time high .

What is the low point of the price for MANTRA Coin (OM)?

MANTRA (OM) token’s lowest price was $0.02044 on Jun 15, 2023 .

MANTRA Coin(OM) Technical Outlook:

MANTRA (OM) coin, which was $0.88760 on March 15, 2021, fell to $ 0.02 on June 05, 2023. Recently, this level has started to consolidate. The increase in volume is remarkable. Closes above our falling trend line should be followed for the long position. Particularly strong resistance at $0.03871, the volume zone of the downtrend. Candle closures above the $0.05028 price level were not followed in order to change the market structure and start the uptrend. As long as this level is not passed, bullish movements will remain in reaction. Fibo levels should be followed as resistance on rises.

Our support point: $0.02086 resistances: $0.05028 – $0.08703 – $0.3559 – $0.21126 – $0.39717.

Investment information comments, and recommendations contained herein are not within the scope of investment consultancy . The content, comments, and recommendations herein are not guiding but general . These recommendations may not suit your financial situation and risk and return preferences . Therefore making an investment decision based solely on the information herein may not yield results that meet your expectations .